Single Family Rentals

Update March 20th, 2024

The Las Vegas rental market is stable but noticeably slower than in years past. Rents are holding at 30-40% above pre-pandemic levels, but not continuing to increase. In 2024, Owners should focus on stabilizing rent rates to keep quality Tenants in place. I believe Resident retention is more important than ever.

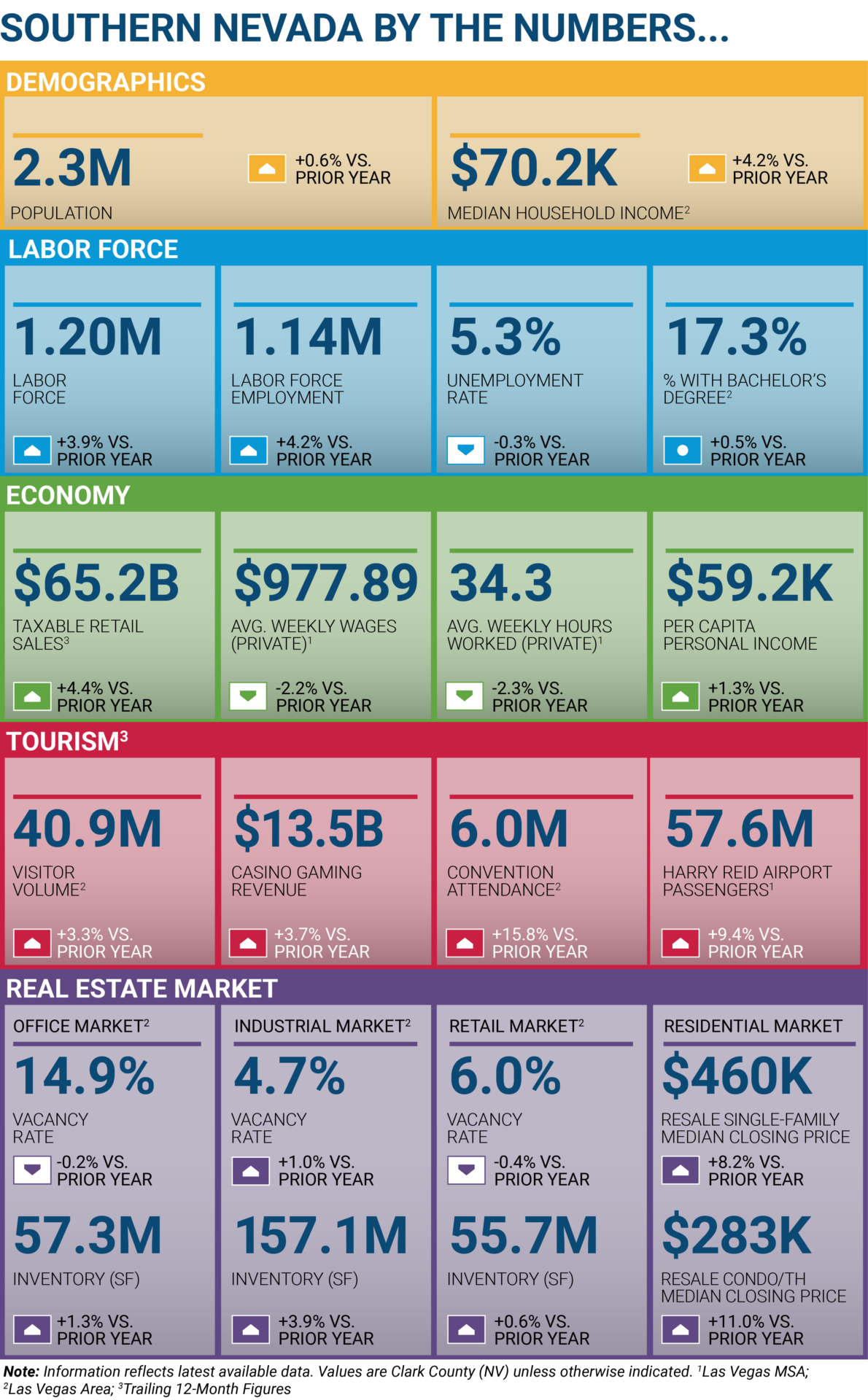

The Las Vegas housing market is unique because of its strategic importance in the southwest (hub between multiple major markets), growth/growth potential, and relative affordability.

The Las Vegas rental market is undergoing a post pandemic stabilization.

Rents are holding steady in 2024.

The rent increases the past few years have been staggering (40%) and have proven to have stabilized.

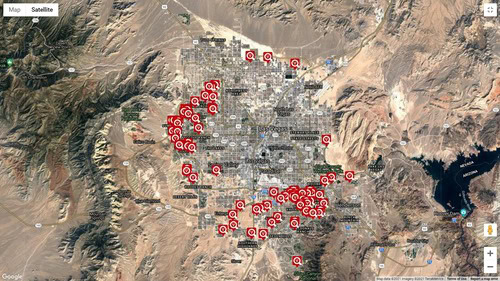

Institutional Investors

The unknown is how the institutional investor purchases will impact our market long-term.

We are in unprecedented times with the billions and billions of dollars Wall Street has pumped into the residential real estate market.

If you’re unfamiliar with institutional investors in the sunbelt region google it or read an article like this one from Multi-Housing News or this article about Las Vegas Housing Trends in 2024 and 2025.

Some Wall Street investors are even funding purpose built rental neighborhoods (Build To Rent or BTR)….think apartment building living but all detached single family residences.

Every neighbor is a renter…….

Las Vegas Rental Statistics Example # 1

Westwood Village neighborhood:

3 bedroom Green Valley, Henderson 89074

Market rent – $1,995/mo

Market value – $400k

Swipe right for additional photos

Las Vegas Rental Statistics # 2

Green Valley Ranch:

4 bedroom Green Valley Ranch, Henderson 89012

Market rent – $2500/mo

Market value – $500k

Swipe right for additional photos

Las Vegas Rental Market Statistics Example # 3

Summerlin West **new home**:

3 bedroom West Summerlin, Las Vegas 89138

Market Value – $800,000

Market rent – $3200/mo

swipe to view more photos

Las Vegas Rental Market Statistics Example # 4

Red Rock Country Club

(guard gated)

4 bedroom Summerlin South 89135

Market Value – $1,400,000

Market rent – $6000/mo

Swipe right for additional photos

Click to view more examples of market value and rent rates.

Low Property Taxes

Low property taxes are one of the main reasons Las Vegas investment properties are so attractive.

As a general rule of thumb, annual estimated property taxes can be calculated at roughly .5%-.75% of the purchase price. For example, a property purchased for $400k would have annual property taxes of around $2,000 annually. Here’s a more detailed article we have written about Las Vegas Property Taxes.

This public search page can be used to determine current property taxes for any property in Las Vegas and Henderson: Clark County Treasurer.

The Future of Las Vegas...our city continues to grow.

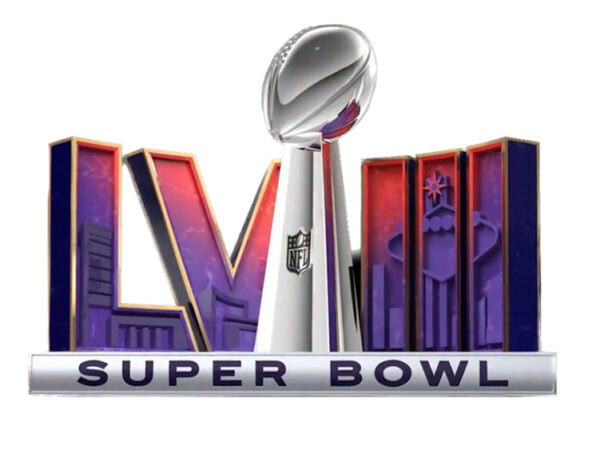

2024 Super Bowl

Slated for February 11, 2024, the Super Bowl will take place at the recently opened Allegiant Stadium and marks the first time Las Vegas and the state of Nevada will welcome the Super Bowl.

The 2024 Super Bowl is expected to bring about $600 million in spending to the city.

Las Vegas is expected to grow its portfolio of pro sports teams to include MLB and NBA in the near future.

Investing in Residential Real Estate is what we do.

Las Vegas investment properties have low operating costs compared to other major markets: low maintenance costs, low taxes, and reasonable insurance costs.

+0

Years Experience

+0

Houses Managed

+0

Happy Tenants

+0

move-in photos

Owner FAQs

Our Owner FAQ section was designed to help navigate some of the questions that come up in property management.

Pricing

Our firm has crafted a culture designed around full transparency, reliable communication, and technology.

Areas We Serve

We are selective when it comes to new partnerships to ensure we provide the highest level of attention to each Owner.